Mortgage calculator 10 year arm

30-Year Mortgages and Extra Payments. Current 5-Year Hybrid ARM Rates.

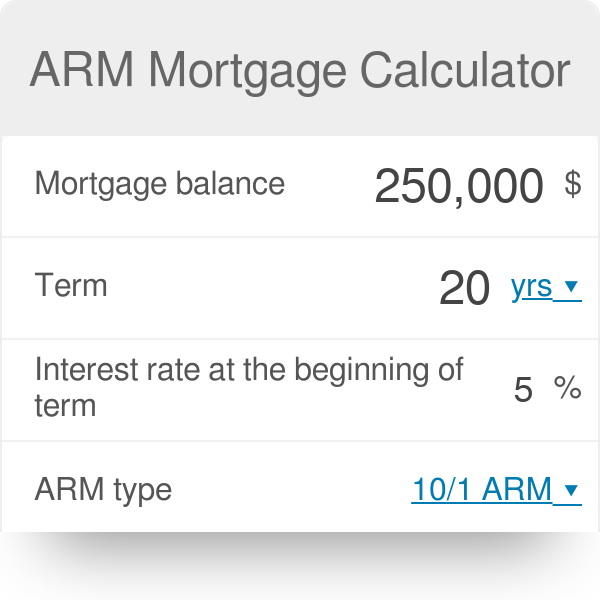

Arm Mortgage Calculator

With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time.

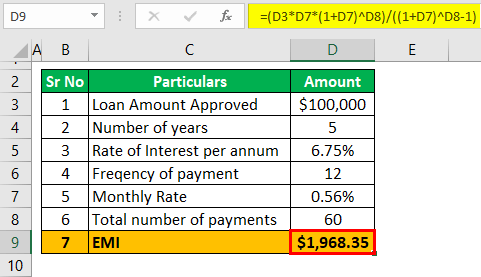

. Fractional points are commonly used by lenders to round off a rate to a standard figure such as 475 percent rather than something like 4813 percent. Mortgage loan calculator. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages.

To find out if a 10-year mortgage is right for you do the math using the Bankrate Mortgage Calculator. 10-Year Refinance Rates. A 15-year fixed rate mortgage on the other hand may offer a lower interest rate that wont fluctuate like an ARM loan but requires a higher monthly payment compared to a 30-year fixed.

If a home buyer opts for a 30-year loan most of their early payments will go toward interest on the loan. Its popularity is due to low monthly payments and upfront costs. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

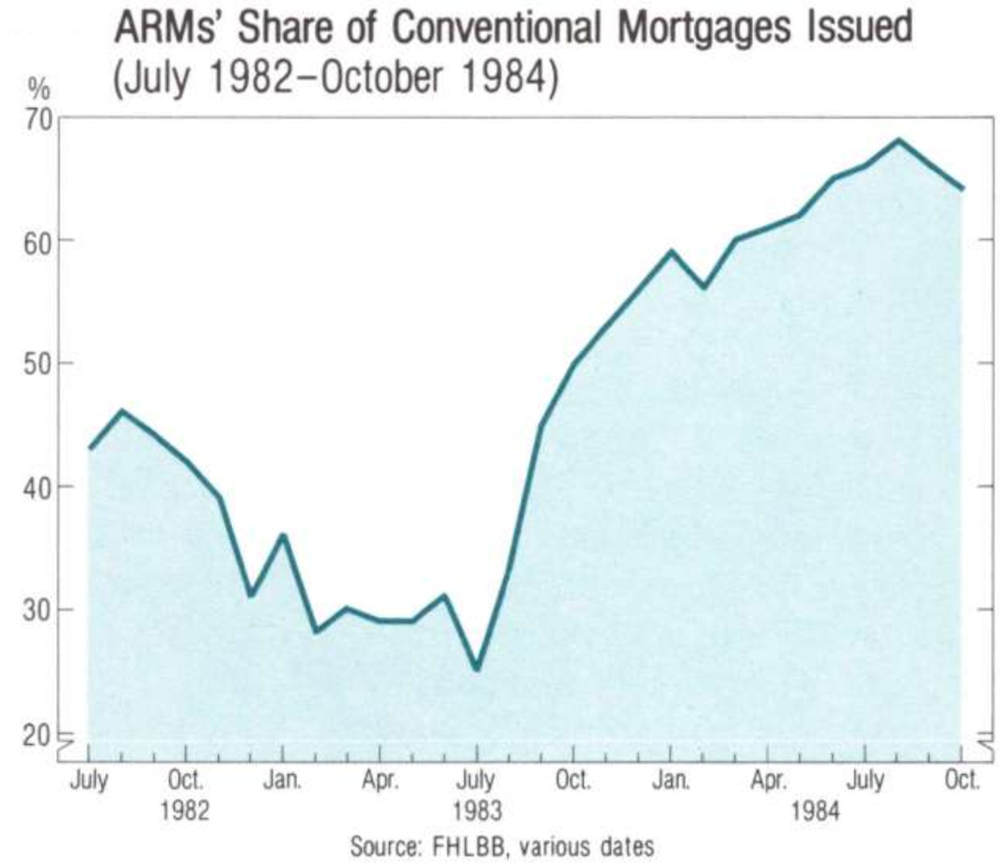

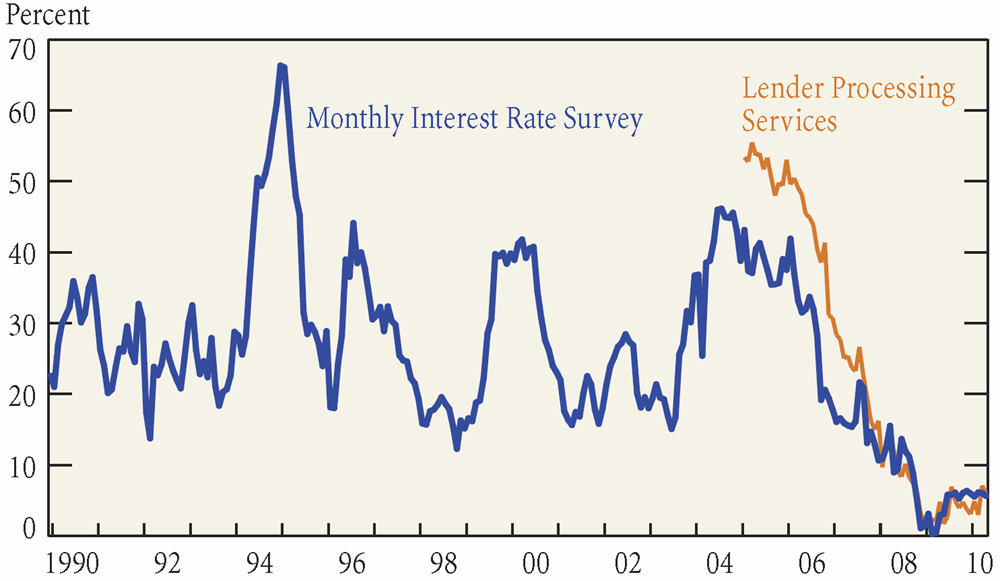

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. Given that ARM loans are variable the interest rate could end up being higher than with a 30-year fixed rate mortgage that has a locked-in mortgage rate. The lower initial interest rate of an adjustable.

The first two options as their name indicates are fixed-rate loans. Mortgage rates valid as of 31 Aug 2022 0919 am. Get the latest interest rates for 10-year fixed-rate mortgages.

You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options. The closest Treasury security in duration to that is the 10-year note. If you want to pay off your mortgage in 5 years you can use this early mortgage payoff.

Fixed Rate Mortgage vs. For example with 51 ARM expect to see a reduced rate for the first 5 years of the loan during the fixed-rate introductory phase. The average APR on a 15-year fixed-rate mortgage rose 2 basis points to 5235 and the average APR for a 5-year adjustable-rate mortgage ARM fell 4 basis points to 5330 according to rates.

Mortgage Tax Savings Calculator. A 10-year mortgage comes at the price of a higher monthly payment longer loan terms have lower monthly payments. The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgages.

Read How to Pay Off Mortgage Earlier to learn some tips on how to pay off your mortgage quicker. Most prospective borrowers choose either a 15-year mortgage or a 30-year mortgage. Todays mortgage rates in Georgia are 5972 for a 30-year fixed 5196 for a 15-year fixed and 5469 for a 5-year adjustable-rate mortgage ARM.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. This Mortgage Points Calculator allows you to use either positive or negative discount points. The simplest explanation for why the 10-year US.

Use the mortgage calculator with PMI and extra payments to calculate your monthly or biweekly mortgage payments. On the above house loan calculator you can see that it allows you to select a loan term length of loan anywhere from 10 years all the way to 30 years. 185 percent of your loan amount per year billed monthly.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 7 or 10 years. The full owner of the mortgaged property until the last monthly payment is made. The following table shows the rates for ARM loans which reset after the fifth year.

10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages. So if you paid monthly and your monthly mortgage payment. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan.

The following table shows the rates for ARM loans which reset after the tenth year. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Treasury garners the most attention in the mortgage world is because the assumed duration of a 30-year mortgage before payoff or default is 7 years.

In the drop down area you have the option of selecting a 30-year fixed-rate mortgage 15-year fixed-rate mortgage or 51 ARM. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Use our free mortgage calculator to estimate your monthly mortgage payments.

Current 10-Year Hybrid ARM Rates. Historical 30-YR Mortgage Rates. By default refinance loans are displayed.

Likewise for a 101 ARM your interest rate will be decreased for the first 10 years of the mortgage. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for. Depending on your financial situation one term may be better for you than the other.

Interest Only ARM calculator. Getting ready to buy a home. Rates are influenced by the economy your credit score and loan type.

A 15-year fixed-rate mortgage has a higher monthly payment because youre paying off the loan over 15 years instead of 30 years but you can save thousands in interest over the life of the loan. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. Both selections have a marked effect on the interest rate you are offered.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 5 or 7 years. This means your interest rate and monthly payments stay the. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market.

How to pay off mortgage in 5 years calculator. The average mortgage interest rate is around 55 for a 30-year fixed mortgage. Some ARM lenders may also allow you to.

Be sure to check back. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. The 30-year fixed-rate loan is the most common term in the United States but as the economy has went through more frequent booms busts this century it can make sense to purchase a smaller home with a 15-year mortgage.

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Mortgage Calculator Amortization Schedule Mortgage Rates

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Va Mortgage Calculator Calculate Va Loan Payments

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

Downloadable Free Mortgage Calculator Tool

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

Free Interest Only Loan Calculator For Excel

Adjustable Rate Mortgage Calculator Step By Step

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Zmebbvwvmwqzkm

Adjustable Rate Mortgage Calculator Rate Change On Any Day

Adjustable Rate Mortgage Calculator Step By Step

10 1 Arm Calculator 10 Year Hybrid Adjustable Rate Mortgage Calculator